How Insurance Advisor can Save You Time, Stress, and Money.

Wiki Article

The Buzz on Insurance Quotes

Table of ContentsA Biased View of Insurance Asia Awards9 Easy Facts About Insurance Account ShownLittle Known Questions About Insurance Agent.Not known Incorrect Statements About Insurance Everything about Insurance AccountInsurance Meaning for Beginners

Although acquiring an insurance plan that satisfies your state's needs might permit you to drive without damaging the law, reduced coverage restrictions don't provide adequate security from a monetary perspective. Numerous states only call for vehicle drivers to have liability insurance, as an example. This suggests that in the case of an accident, motorists can sustain tens of thousands of dollars of damage that they can't cover on their own, in some cases even leading to monetary mess up.

To conserve money, you can select a greater insurance deductible for your accident and detailed insurance coverage. Deductibles can go as high as $2,500. Despite the fact that that's a whole lot of money to pay in an at-fault mishap, it's still less pricey than replacing somebody's amounted to BMW. Our Advised Vehicle Insurance Coverage Suppliers In our research study, we ranked USAA as well as Geico as two of the ideal auto insurance service providers in the United States.

Indicators on Insurance Ads You Need To Know

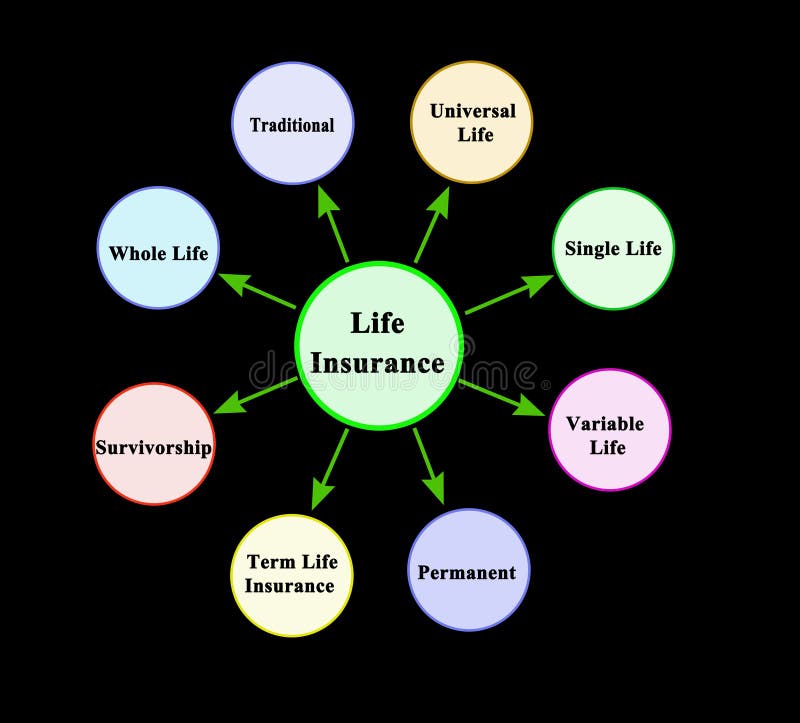

Vehicle Insurance Claims Fulfillment Research Study, SM. What's even more, USAA has a tendency to have the most affordable complete coverage insurance policies out of every carrier that we reviewed, proving that top-notch protection need not come with a premium. Sadly, USAA cars and truck insurance is just readily available for army members as well as their family members, so most drivers won't have the ability to benefit from USAA insurance policy protection.What kind of life insurance policy is best for you? That depends upon a range of factors, consisting of the length of time you desire the policy to last, just how much you desire to pay as well as whether you desire to use the plan as an investment vehicle. Different types of life insurance coverage, Typical types of life insurance coverage consist of: Universal life insurance policy.

Surefire problem life insurance policy. All kinds of life insurance autumn under 2 primary classifications: Term life insurance policy. These plans last for a specific variety of years as well as appropriate for many people. If you don't die within the time frame defined in your plan, it expires without any payment. Long-term life insurance policy.

9 Easy Facts About Insurance And Investment Shown

Usual sorts of life insurance policy policies, Simplified concern life insurance, Ensured problem life insurance policy, Term life insurance policy, Just how it works: Term life insurance coverage is commonly sold in sizes of one, five, 10, 15, 20, 25 or three decades. Insurance coverage amounts differ relying on the plan yet can go right into the millions.

There's generally little to no cash money value within the plan, and also insurers demand on-time settlements. You can choose the age to which you desire the fatality advantage assured, such as 95 or 100. Pros: Due to the marginal money value, it's more affordable than whole life and also various other forms of global life insurance policy.

Insurance Commission Things To Know Before You Get This

As well as given that there's no cash money value in the plan, you would certainly leave with nothing. Indexed global life insurance, How it works: Indexed global life insurance web links the plan's cash money value element to a supply market index like the S&P 500. Your gains are determined by a formula, which is outlined in the plan (insurance companies).Other kinds of life insurance policyGroup life insurance policy is commonly used by employers as part of the firm's office advantages. Costs are based on the group in its entirety, rather than each individual. Generally, employers provide basic coverage free of cost, with the choice to purchase extra life insurance policy if you need much more coverage.Mortgage life insurance covers the current equilibrium of your mortgage and also pays to the loan provider, not your family, if you pass away. Second-to-die: Pays out after both insurance policy holders die. These policies can be utilized to cover inheritance tax or the care of a reliant after both policyholders pass away. Often asked inquiries, What's the best sort of life insurance coverage to obtain? The very best life insurance policy find here plan for you boils down to your needs and budget plan. Which sorts of life insurance policy offer flexible costs? With term life insurance and entire life insurance, premiums typically are repaired, which suggests you'll pay the very same amount on a monthly basis. The insurance coverage you require at every age differs. Tim Macpherson/Getty Images You need to get insurance policy to shield yourself, your household, and also your wide range. Insurance could save you hundreds of dollars in case of a mishap, disease, or disaster. Health and wellness insurance policy and also automobile insurance are required, while life insurance, house owners, renters, as well as impairment insurance policy are motivated. Start absolutely free Insurance policy isn't one of the most awesome to believe about, but it's necessary

for safeguarding yourself, your household, and also your wide range. Accidents, disease, and catastrophes occur regularly. At worst, occasions like these can dive you into deep economic ruin if you do not have insurance policy to draw on. Plus, as your life modifications(state, you get a new work or have a child)so needs to your insurance coverage.

More About Insurance Ads

Listed below, we have actually discussed briefly which insurance coverage you must highly think about buying at every stage of life. When you exit the functioning globe around age 65, which is usually the end of the lengthiest policy you can acquire. The longer you wait to acquire a policy, the higher the ultimate expense.The ideal life insurance policy for you comes down to his response your requirements and also budget. With term life insurance and and also entire insuranceInsurance coverage premiums typically are fixedDealt with which means implies'll pay the same very same every month. Wellness insurance and car insurance coverage are called for, while life insurance coverage, property owners, renters, and impairment insurance coverage are urged.

6 Simple Techniques For Insurance Agent Job Description

Listed below, we've explained briefly which insurance policy coverage you should strongly think about acquiring at every stage of life. Note that while the plans listed below are prepared by age, naturally they aren't all established in rock. Although lots of people probably have short-term handicap through their employer, long-lasting special needs insurance policy is the onethat most individuals require as well as do not have. When you are damaged or unwell and incapable to function, handicap insurance coverage supplies you with a portion of your salary. Once you exit the working globe around age 65, which is typically the Clicking Here end of the longest plan you can buy. The longer you wait to purchase a plan, the higher the ultimate cost.Report this wiki page